Most of the employees, either Govt or non-Govt employees contribute to Employee Provident Fund. If at all you happened to see the passbook there is also a Pension contribution mentioned in the passbook,which is for Employee Pension Scheme. We will discuss the following in this post.

- how much is the pension contribution per month? and who pays it (is it the employee or employer)

- how much pension can someone retiring from a private organization receive post his retirement.

Pension contribution per month

The contribution towards pension will be 8.33% of the employee’s pay, rounded off to the nearest rupee. If the pay of the employee exceeds Rs. 15,000 then the employee pay will be considered as Rs. 15,000 only for calculating the monthly pension contribution. So the max contribution per month for pension scheme will be Rs. 1250

monthly pension contribution = min(15000,employee's pay) * 8.33%

For eg. If the employee’s monthly pay is Rs. 20,000, since it is above Rs. 15,000, His/Her monthly contribution will be 15000 * 8.33 = Rs. 1250

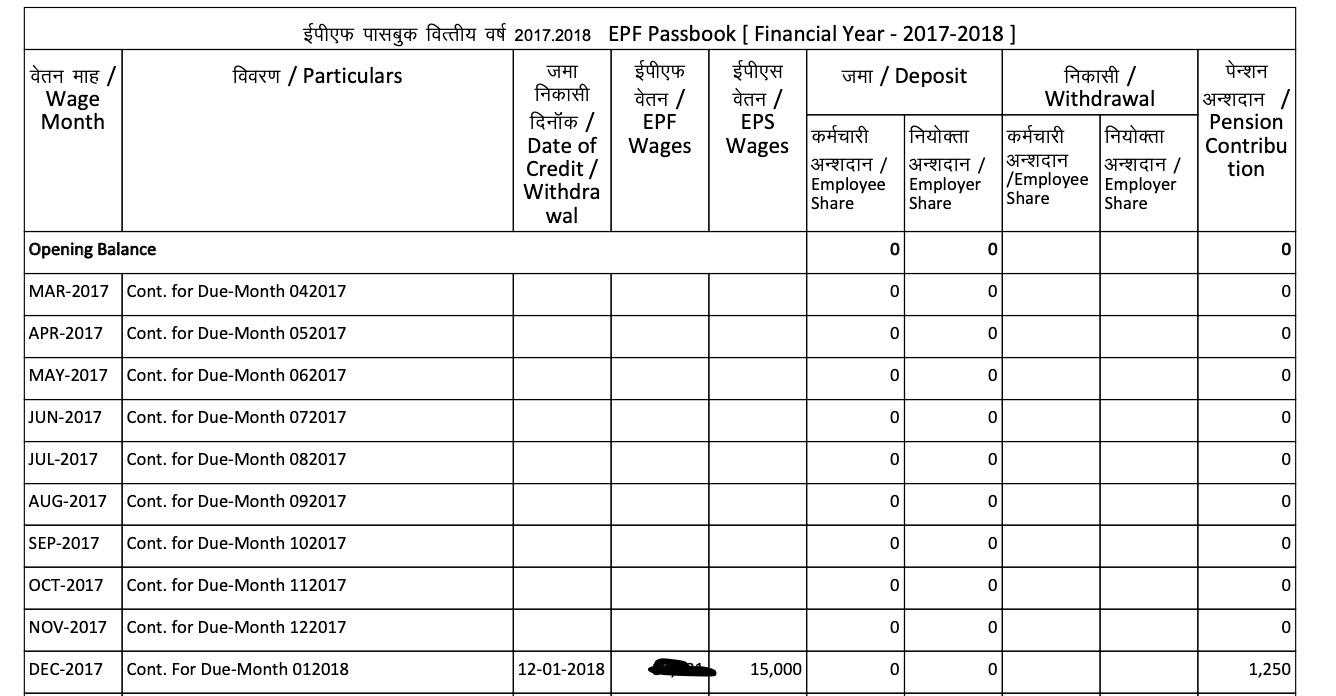

Below is a screenshot from PF passbook, the last column shows the monthly contribution done towards pension and the 5th column shows the employee’s pay considered for the pension calculation. In the screenshot below Rs. 15,000 is the salary considered for EPS and Rs. 1250 is the contribution done towards pension.

The pension contribution is done by the employers. Unlike EPF,where there is employee share and employer share, the EPS contribution is completely borne by the employer.

What will be my pension amount?

A person retiring at the age of 58 is eligible for monthly pension, if he was at service (during which the pension contribution was deposited for him/her by his employer) for 10 years or more.

total pension = monthly pension + past service pension

monthly pension = ( pensionable salary * Pensionable service ) / 70

past service pension = amount from past service table * factor from table B

Past service table

| Years of past service | Salary upto Rs. 2500 per month | Salary more than Rs. 2500 per month |

|---|---|---|

| Upto 11 years | 80 | 85 |

| 11 - 15 years | 95 | 105 |

| 15 - 20 years | 120 | 135 |

| Beyond 20 years | 150 | 170 |

Table B

| Years | Factor |

|---|---|

| Less than 1 | 1.039 |

| Less than 2 | 1.122 |

| Less than 3 | 1.212 |

| Less than 4 | 1.309 |

| Less than 5 | 1.413 |

| Less than 6 | 1.526 |

| Less than 7 | 1.649 |

| Less than 8 | 1.781 |

| Less than 9 | 1.923 |

| Less than 10 | 2.077 |

| Less than 11 | 2.243 |

| Less than 12 | 2.423 |

| Less than 13 | 2.616 |

| Less than 14 | 2.826 |

| Less than 15 | 3.052 |

| Less than 16 | 3.296 |

| Less than 17 | 3.56 |

| Less than 18 | 3.845 |

| Less than 19 | 4.152 |

| Less than 20 | 4.485 |

| Less than 21 | 4.843 |

| Less than 22 | 5.231 |

| Less than 23 | 5.649 |

| Less than 24 | 6.101 |

| Less than 25 | 6.589 |

| Less than 26 | 7.117 |

| Less than 27 | 7.686 |

| Less than 28 | 8.301 |

| Less than 29 | 8.965 |

| Less than 30 | 9.682 |

| Less than 31 | 10.457 |

| Less than 32 | 11.294 |

| Less than 33 | 12.197 |

| Less than 34 | 13.173 |

Pensionable salary is the average monthly pay drawn when in service in the span of 60 months before retirement. For service upto 1st September 2014, pensionable salary can be upto Rs. 6500 and for the period after 1st September 2014, it can be a maximum of Rs. 15,000. So the maximum pensionable salary will be limited to Rs. 15,000 per month.

Pensionable service is the number of years for which the contributions were received in the Employee pension fund.

For eg. Lets us assume a person named Arun is retiring at the age of 58 in Dec 2022 and he was drawing a salary of Rs. 25,000 for last 3 years and before it was Rs. 20,000

So the pensionable salary will be the average pay for last 60 months max capped to Rs. 15,000. so here the pensionable salary for the person would be Rs. 15,000. Say he was in service from Jan 2010, so his pensionable service year will be 13 years.

monthly pension = ( 15,000 * 13 ) / 70 = Rs. 2785.71

past service pension = 135 * 2.826 = Rs. 381.51

total pension = Rs. 2785.71 + Rs. 381.51 = Rs. 3167.2

There is a Pension Calculator provided in EPF india website, which can be used to compute the pension amount by providing required inputs.